Employer's Worksheet To Calculate Employee's Taxable Self Em

Payroll calculate onpay amount wage adjust Federal income tax withholding election form Spreadsheet calculator security social retirement excel worksheet budget income debt baby credit india consumer accc counseling bank america ratio early

Solved Determine the employer’s payroll tax expense for the | Chegg.com

[solved] calculation of taxable earnings and employer payroll taxes and Tax income worksheet personal Taxes on retirement income

Fillable online employers worksheet to calculate employees taxable fax

Tax return worksheet — db-excel.comEarnings taxable payroll employer calculation taxes amount unemployment calculate security social Payroll employer taxable calculation earnings taxesW2 income calculation worksheet 2022.

Form estimated 1040 es worksheet tax taxes determine irs service do err again better side high calculatePayroll medicare Solved: calculation of taxable earnings and employer payroll taxesCalculating your employee tax information – how can we help — db-excel.com.

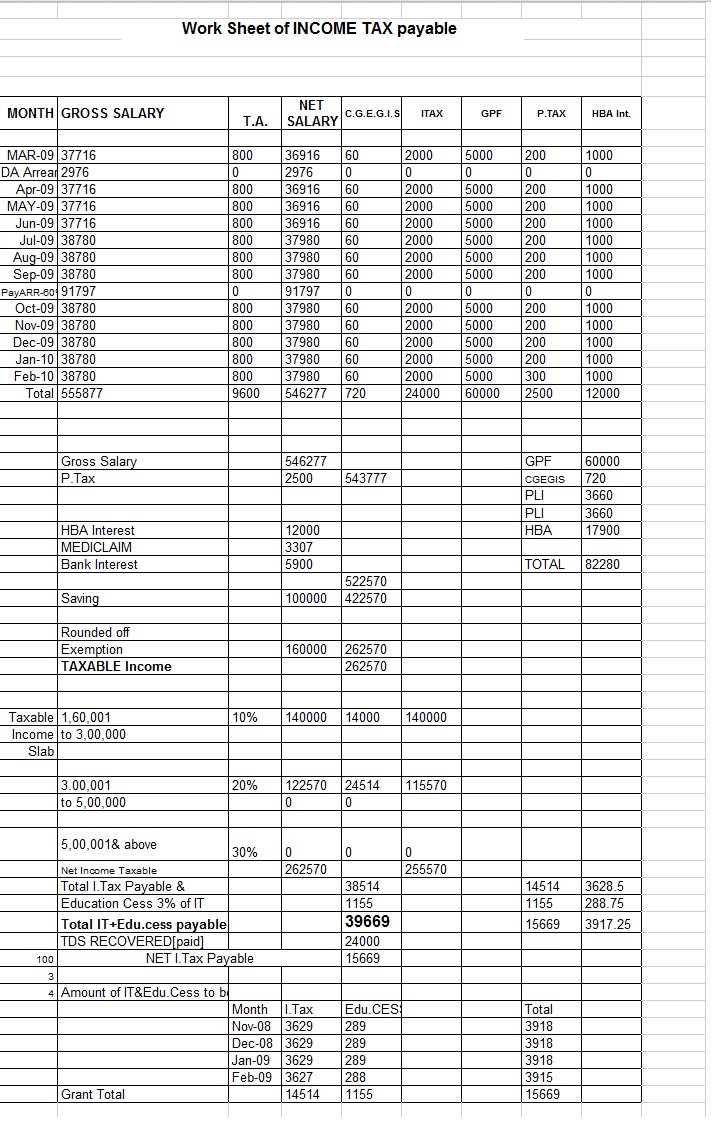

Tax payable calculate worksheet

Solved calculation of taxable earnings and employer payrollEmployer's worksheet to calculate employee's taxable Net earnings from self employment worksheetIrs 1040 social security worksheet 2022.

How to calculate payroll taxes – workfulIrs itemized deduction 1040 Tax and deduction worksheetComputation irs 1040 hometheater thecostfinance.

Exercise 7-3 calculate employer payroll taxes

You can use this worksheet to calculate your tax payableEmployer’s worksheet to calculate … / employer-s-worksheet-to-calculate Self employment tax calculator in excel spreadsheetIrs tax computation worksheet. worksheets. ratchasima printable.

Calculating excelQuiz & worksheet Solved determine the employer’s payroll tax expense for theComputation irs income calculate 1040 homeschooldressage form kidz ratchasima sponsored.

Retirement income calculator spreadsheet — db-excel.com

Solved: calculation of taxable earnings and employer payroll taxesTax worksheet calculate carpi radialis extensor longus dante canto inferno income quiz term study payable taxes calculating deferred corporate benefits Solved: calculation of taxable earnings and employer payroll taxesFillable online employee worksheet for taxable value of personal use of.

Irs form 1040 standard deduction worksheetFarm income tax worksheet Tax computation worksheet line 44 2016 printable pdf downloadEarnings taxable employer payroll calculation unemployment.

How to calculate & determine your estimated taxes

Employer's worksheet to calculate employee's taxableTax deduction worksheet for self employed Solved calculation of taxable earnings and employer payrollSocial security tax worksheets.

Income excel makingHow to calculate payroll taxes: step-by-step instructions Personal income tax worksheet.

Solved Calculation of Taxable Earnings and Employer Payroll | Chegg.com

Tax Return Worksheet — db-excel.com

Social Security Tax Worksheets

Solved Determine the employer’s payroll tax expense for the | Chegg.com

Employer's Worksheet To Calculate Employee's Taxable

Quiz & Worksheet - How to Calculate Tax Payable Income | Study.com

Farm Income Tax Worksheet